Life insurance and investment in a single, flexible plan.

As you journey through life, your protection should grow with you every step of the way. PRUWith You Plus is a life insurance and investment plan, tailored to your unique needs to protect you and your family.

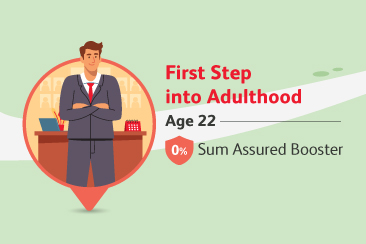

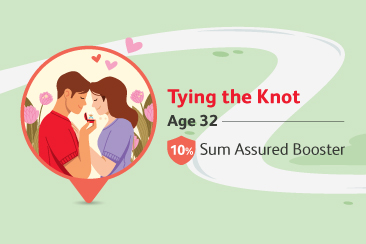

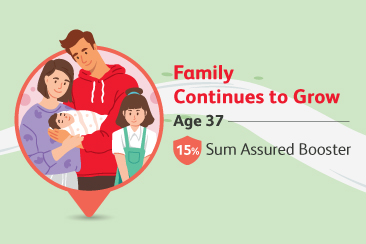

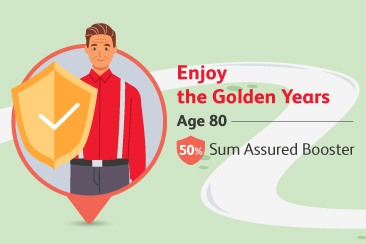

This plan provides Sum Assured Booster that increases your coverage over time with an automatic extension up to age 100, providing security and peace of mind. It also extends protection to your children from birth until age 7, ensuring your little ones are covered.

PRUWith You Plus not only protects you but also safeguards what matters most—your loved ones. Secure your future and theirs with confidence, knowing you have comprehensive protection that evolves alongside you. Because what matters to you, matters to us too.

Download the leaflet in your preferred language.

Terms and Conditions apply.

Safeguard you and your loved ones

Terms and Conditions apply.

Follow Ethan's life journey

Your First Step to a Safer Tomorrow

Through our Gift of Protection campaign, receive RM250 cash reward with PRUWith You Plus, or RM125 with PRUMan or PRULady, when you meet the campaign criteria.

Terms and conditions apply.

Extra plans

You can also add extra plans to strengthen your coverage. Choose from plans that:

|

Build a lump sum for your child’s future, a rainy day or whatever you choose: |

|

|

Pay you a lump sum or your medical cost or a regular income if you have an accident: |

|

|

Pay you a lump sum if you have a critical illness: |

|

|

Pay for your hospital bills: |

|

|

Pay your premiums upon Total and Permanent Disability (TPD), death or diagnosis of critical illness |

|

|

Pay annual instalment when you're diagnosed with TPD/Critical Illness: |

|

|

Protect your unborn or young child and their mother: |

|

|

Pay additional death benefit:

|

Learn more

More about PRUWith You Plus

A life insurance and investment plan that provides coverage against death or TPD. You can also choose a range of high-quality investment funds and extra insurance benefits that are right for you and your family.

About your plan

|

How much does it cost (your premium)? |

Insurance premium will vary according to the amount of coverage, age, gender, smoker status and policy term. |

|

How long will I need to pay premiums? |

You pay premiums for as long as you have your plan in force. |

|

How long does the coverage last? |

Choose to stop your plan at

|

|

How old must the life assured (the person covered by the policy) be when the policy starts? |

Before birth: After 13 weeks into pregnancy. After birth: Age 1 – 70 years old.

|

|

What’s the minimum amount of coverage? |

RM10,000 |

|

What’s the maximum life coverage? |

Our underwriters decide this, depending on your circumstances. |

*All ages in this table are based on age next birthday (ANB), except for age 100, which is based on attained age.

Important notes

-

This content contains only a brief description of the product and is not exhaustive. You are advised to refer to Prudential Assurance Malaysia Berhad (PAMB)’s Brochure, Product Disclosure Sheet, Product / Sales Illustration, Fund Fact Sheet (if any) before purchasing the plan, and to refer to the terms and conditions in the policy document for details of the features and benefits, exclusions and waiting periods under the policy.

-

This product comes with Extension of Coverage Term to extend the term of basic plan up to the Policy Anniversary of Life Assured’s age 100. For rider(s), if applicable, the rider's term will be extended up to the Policy Anniversary of Life Assured's age 100 or the rider’s maximum coverage term, whichever is earlier. Unless you request to disable the Extension of Coverage Term, your policy will be auto extended as long as it has sufficient value of units to be deducted to pay for the relevant charges, fees and taxes during the extended term. To ensure sufficient value of units, additional premium is likely required during the extended term. During the extended coverage term, the coverage provided by the basic plan and rider(s) (if applicable) will remain the same.

PLEASE NOTE THAT THIS IS AN INSURANCE PRODUCT THAT IS TIED TO THE PERFORMANCE OF THE UNDERLYING ASSETS, AND IS NOT A PURE INVESTMENT PRODUCT SUCH AS UNIT TRUSTS.

PROTECTION BY PERBADANAN INSURANS DEPOSIT MALAYSIA (“PIDM”) ON BENEFITS PAYABLE FROM THE UNIT PORTION OF THIS CERTIFICATE/POLICY IS(ARE) SUBJECT TO LIMITATIONS. Please refer to PIDM’s Takaful and Insurance Benefits Protection System (“TIPS”) Brochure or contact Prudential Assurance Malaysia Berhad or PIDM (visit www.pidm.gov.my).

Investment Linked Insurance FAQ

What is investment-linked insurance?

Investment linked insurance or ILPs (insurance linked insurance policies) provide life insurance and investment components to the insured. ILPs are designed to help you accumulate wealth and at the same time, provide protection in the case of death, or total and permanent disability. The sum assured can vary according to your policy.

How does investment-linked insurance work?

In investment-linked insurance, a portion of the premiums paid by the policy holder covers life insurance while the other portion is invested in a specific fund. The insurance component usually covers death benefits as well as critical illness and disability. For the investment component, the investment fund is divided into equal valued units that you can purchase.

Why is ILP good?

Investment linked policies have several benefits including:

-

High flexibility - The insurance coverage is adjustable to suit your needs or stage in life. You can also withdraw for quick cash if needed or pause paying premiums if you have financial issues.

-

Leverage your money for both wealth accumulation and wealth protection at the same time.

-

ILP’s insurance component cost is very low for young individuals

-

You have control over the decision company in an ILP and potentially higher returns depending on your decisions.

Are the returns of investment linked insurance guaranteed?

No, the returns of investment linked insurance is not guaranteed. This is due to the rise or fall of unit prices as according to the investment’s market value.

Is ILP a high risk product?

ILPs are not risk-free as the value depends on the investment portion’s performance.

Common ILP risks include:

-

Investment risk - Returns are not guaranteed and past returns are not an indication of future performance.

-

Insurance coverage charges - Premium rises with age and thus, your units might not cover the charges. Cost of insurance coverage might also increase if there is a rise in claims.

Are ILPs worth it?

This depends on several factors including:

-

Your goals - What are your investment or financial goals?

-

Your risk appetite - While you can adjust the investment and insurance portions according to the risk you’re willing to take, always do your research to ensure that you’re investing in funds that are able to deliver expected returns. Consult one of our team to learn more about all your options.

-

Your age - How much time do you have to reach your goal? Younger individuals have more time to invest and thus, can opt for more aggressive investment funds if they want to. Our advisors will be able to plan a strategy that suits your needs.

How long should I hold my investment-linked insurance policy?

There’s no fixed period, and thus, it’s pretty much up to you. However, because of the high initial costs, a long-term strategy will probably give you more returns.