Community Investment

Our Community Investment (CI) programmes represent our commitment to provide focused and practical support to local communities in need.

In step with Prudence Foundation’s mission, we work with local and national government agencies to make lasting contributions in three key areas of:

-

Protection

-

Education

-

Growth

Our history

Over the years, our initiatives have evolved and grown to encompass sustainable projects and activities that support our objectives.

2011

- We started out with PRUKasih, a pilot project to provide financial protection to low-income household communities.

2013

- We established a Corporate Responsibility department, dedicated to developing and driving CI initiatives in Malaysia.

- PRUKasih grew to cover a second community, with RM50 million granted towards its expansion.

- Floods in December prompted us towards establishing our disaster preparedness and recovery focus. In conjunction with the regional development of an advocacy programme, we aided flood affected areas through Mercy Malaysia's mobile clinics.

2014

- In March, we introduced two financial education programmes, Cha-Ching "Live in Malaysia" for primary school students and DuitRight for those in secondary.

- We also launched the regional Safe Steps Natural Disaster programme focused on disaster preparedness.

2015

- Karnival Cha-Ching made financial education available to larger groups of children.

- We piloted a financial education programme for adults known as Adult Financial Education.

- During the severe flooding in Pahang, Kelantan and Terengganu, we partnered with social enterprise organisation EPIC Home to build 14 homes in Kelantan's post-flood areas.

2016

- We developed & piloted the Cha-Ching Curriculum in 10 schools in Malaysia.

- The Safe Steps Road Safety module was introduced through school and media activations.

- We provided disaster relief items directly to Jabatan Kebajikan Masyarakat (JKM) for more efficient distribution to post-flood areas.

2020

- We established Covid-19 Relief Fund to help communities and individuals affected by the pandemic.

2022

- We launched an enhanced protection plan PRUKasih Aman to replace PRUKasih so that we can give all B40 communities in Malaysia access to financial protection.

2024

- We launched a financial education programme for youth aged 18-29, with a special focus on university students, to help them learn the pathways to financial independence.

- We have launched the 3rd Cohort of the PRUCare Farming Sustainability Programme in Kota Belud, Sabah. This initiative aims to empower communities through sustainable agriculture, fostering a greener future.

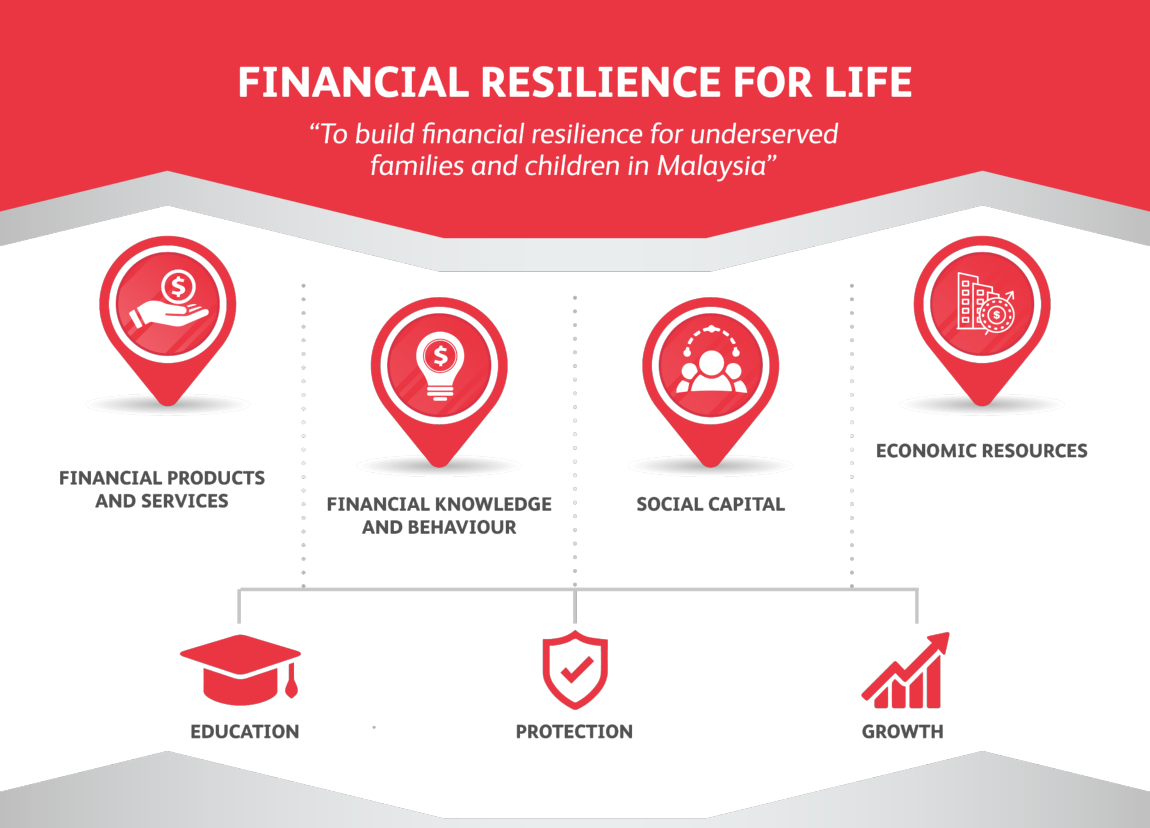

Strategy framework

The road to financial resilience

Our strategy framework has been created to drive meaningful and lasting impact.

A key theme moving forward is to develop deeper and more sustainable engagement in schools and communities, ensuring positive impact through measurable results.

Key strategies at a glance

|

Protection |

|

|

Education |

|

|

Growth |

|

|

Volunteers |

|

United Nations Sustainable Development Goals

Our Focus Areas

Volunteerism

Volunteering is our central philosophy.

We actively engage in campaigns to support our local programmes through internal communities. Our Prudential employees and agents form the backbone of our programmes’ success. They represent the hearts and hands of our initiatives.

Our volunteering activities provide an avenue for employees and agents to develop skills and an understanding of our community investment efforts. We also aim to help them connect with our vision to build resilience for life.

The number as of year 2024:

1,286

Total Volunteers connected

8,216

Volunteer hours

Our People who have volunteered

11,703

Overall Volunteers connected

70,971

Overall Volunteer hours

Achievements

News & events

2024

Introduction to Youth Financial Education

This module is designed for youth aged 18-29, with a one-day programme consisting of two sessions on cash flow management, debt management, insurance & investment, focusing on university students.

Youth Financial Convention in UNIMAS Sarawak

In collaboration with Universiti Malaysia Sarawak (UNIMAS), we hosted the “Konvensyen Kewangan Siswazah 2024” in Sarawak. The convention was graced by YB Datuk Dr. Annuar Bin Rapaee, Deputy Minister, Minister of Education Sarawak, and the Vice Chancellor of UNIMAS. Over 1,000 university students from nearby institutions participated to learn about financial management.

Soft launching of Cha-Ching Money Adventure$ in Malaysia & Contribution in Karnival Celik Kewangan

As part of the expansion of our Cha-Ching Programme, we introduced the Cha-Ching Money Adventure$ initiative through a soft launch. Additionally, we participated in ‘Karnival Celik Kewangan” organised by Bank Negara Malaysia to promote early awareness of money management among the public.

Dengue Prevention Initiative

In collaboration with Taylor’s Impact Lab, we launched this programme to engage communities by clearing mosquito breeding grounds and awareness on Dengue prevention among residents.

Regional Volunteers Programme In Thailand

Prudence Foundation and over 70 PRUVolunteers from 16 countries, including Malaysia, joined forces to restore homes for elderly and flood-affected families in Sukhothai, Thailand. The initiative, led by Prudential Thailand, repaired and rebuilt 12 homes with support from senior executives and regional teams.

3rd Cohort PRUCare Farming Sustainability Programme

We are proud to launch the 3rd cohort of the PRUCare Sustainable Farming Programme, empowering 100 families in Kota Belud, Sabah with the skills to cultivate their own food and establish sustainable sources of income. This initiative reflects our commitment to fostering self-sufficiency and long-term community resilience.

2023

Introduction to Cha-Ching Money Adventures

This game introduces students to the basics of financial literacy. Students embark on an adventure with the Cha-Ching band and learn the concepts of Earn, Save, Spend and Donate.

Introducing SAFE STEPS Kids - Climate Change

Prudence Foundation premiered SAFE STEPS Kids Climate Change, an animated video, to help children learn preventive actions to combat for climate change. The video featured Cartoon Network characters and was launched in Kuala Lumpur by Tuan Nik Nazmi bin Nik Ahmad, Malaysia’s Minister of Natural Resources, Environment, and Climate Change, and Marc Fancy, Executive Director of the Prudence Foundation.

Digital Financial Literacy

We partnered with Pandai Education to give 625,000 Malaysian students free access to Cha-Ching’s financial literacy curriculum on the Pandai App and web portals.

Karnival Cha-Ching at Sarawak State Library

In collaboration with Bank Negara Malaysia, we hosted a 2-day Karnival Cha-Ching in Sarawak during Financial Literacy Month. The carnival was graced by YB Datuk Dr. Annuar Bin Rapaee, Deputy Minister, Minister of Education Sarawak, and Dato’ Marzunisham Omar, Deputy Governor of Bank Negara Malaysia. Over 600 Students from 7 primary schools joined the programme to learn money management through fun learning activities.

Regional Volunteers Programme

The Regional Volunteers Programme is as a platform for Prudential staff to provide meaningful, sustainable, and long-term assistance to communities in times of disaster. The programme is managed by Prudence Foundation. Since March 2023, we have sent 16 staff to Cianjur, Indonesia, to help communities, impacted by the earthquake, build houses, water supply and library.

2022

PRUKasih Aman Launch

We launched the PRUKasih Aman protection plan to replace PRUKasih so we can offer protection to all Malaysians in need instead of a limited number of communities.

PRUKasih Congregated Financial Education 2022

This is a new initiative developed in collaboration with Agensi Kaunseling & Pengurusan Kredit (AKPK) to build awareness amongst communities on financial management using interactive practices.

PRUKasih Taylor's Entrepreneurship programme for people with disabilities

This entrepreneurship programme equips people with disabilities from the Beautiful Gate Foundation with entrepreneurship knowledge and skills so they can sustain their income.

Cha-Ching Hackathon

In collaboration with Taylor's Education community, we hosted a Hackathon with Cha-Ching programme winners from 6 schools in W.P. Kuala Lumpur.

H.U.G Programme for Volunteers

We offer our volunteers an interactive training to boost their programme management skills and to support them in their goal of helping people.

2021

PRUKasih New Initiative

-

Adult Financial Education

For this, we are running Financial Education for 35 communities with the collaboration with AKPK using the virtual platform to help them manage their finances well.

-

PRUKasih Taylor's Entrepreneurship program

In helping the B40 group, we are launching this program to all the 35 communities to boost their income during this Pandemic time.

-

Provided COVID-19 Coverage

Through its new initiative COVID-19 PRUKasih Cover, we hope to address some of these concerns and offer our communities peace of mind by providing the protection that they will need when they are infected with no income generated.

-

Food aid initiative to all the PRUKasih communities around Malaysia & NGO's

We with Prudence Foundation, working together on logistics and coordination to deliver food supplies to the underpriviledged communities and stranded students especially in the rural area.

Financial Education for students (Cha-ching & DRP)

-

Financial Education For Students through virtual

We are converting our Education program into virtual to improve the students understanding of financial products, concepts, and risks.

-

Online contest in social media

In the way to encourage the students, we launch online contest related financial on Instagram platforms with exciting content to be shared every month. Follow us on Instagram - duitrightplus.

-

Virtual Training to all Teachers

As teachers were important to teach students, we also in enhancing their financial literacy skills to the digital platform.

Volnteers Appreciation

-

Volunteer Loyalty Program (VLP)

For this year, we are launching a new loyalty program to appreciate them for their effort and time help our communities to be sustainable.

2020

-

2020 key focus on financial education programme:

-

Case study on reaching the entire district of Bintulu

For this year, we are providing financial literacy to all the schools in the district of Bintulu, Sarawak and also conducting a study on how financial literacy can impact the entire community.

-

Launch of Cha-Ching Financial Accreditation (CCFA)

CCFA is an online platform and ecosystem developed to provide professional development, inspire excellence and recognise achievement among teachers who are trained and empowered to teach financial education in their schools.

-

CCC going online

CCC is going online to help teachers to engage with students and continue to learn financial education even when they are at home.

-

Target to reach 50,000 students in Malaysia

This year, we targeted to reach more students to equip them with financial knowledge aligning with the Financial Education Network (FEN)’s initiative

-

-

PRUKasih entrepreneurship programme:

-

Collaboration with Taylor’s Community to reach out to the selected PRUKasih communities on our Entrepreneurship Programme to help the participants generate sustainable income and help sharpen their mindset for business ventures.

-

-

Free COVID-19 protection plan through the Pulse app:

-

Upon installation of the Pulse app, our New Special COVID-19 Coverage awarded RM1,000 cash reliefs to non-customers in communities that were diagnosed and hospitalised. This amount was doubled for Prudential customers in the communities who registered for the Special COVID-19 Coverage on Pulse i.e. RM2,000 cash relief and RM20,000 death benefit. A link is provided to them according to their communities.

-

2019

First congregate financial education started

-

The first congregation luncheon was held at PPR Intan Baiduri with the speaker from MFPC on 22 September 2019, 77 PRUKasih members joined the programme to improve their financial literacy knowledge.