COVID-19 Hospitalisation & Post Vaccination Campaign

COVID-19 HOSPITALISATION ASSISTANCE & COVID-19 UPGRADED PLAN ASSISTANCE COVERAGE HAVE ENDED.

Eligible claims must be submitted no later than 3 months from date of diagnosis.

Please refer to new announcement on the COVID-19 Medical Plan Coverage. Find out more.

For on-going Post Covid-19 Vaccination Coverage, please refer here.

Prudential Malaysia customers, we are here to help you and your family face the uncertainties of the pandemic with complimentary coverage for hospitalisation due to COVID-19 infection and post vaccination benefits. Here’s what you’ll be covered for if you sign up with Pulse by Prudential:

-

Hospitalisation coverage due to COVID-19 infection

To ensure that our customers are well-protected during these unprecedented times, we are allocating RM20 million to provide assistance to our customers, whose medical plans have general pandemic exclusion in particular. As such, we will be providing reimbursement on goodwill basis to cover for COVID-19 infection related medical expenses based on the following:

COVID-19 Hospitalisation Assistance:

-

Up to RM5,000 reimbursement for Category 3

-

Up to RM15,000 reimbursement for Category 4

-

Up to RM20,000 reimbursement for Category 5

COVID-19 Upgraded Plan Assistance:

For our customers whose current medical plans were upgraded from PRUMajor Med plans previously, we will provide reimbursement on goodwill basis to cover for COVID-19 infection related medical expenses based on the policy/certificate document of their previous medical plans.

On the other hand, for customers with medical plans without pandemic exclusion, reimbursement for medical expenses due to COVID-19 infection will be based on their medical plans’ terms and conditions.

-

Post COVID-19 vaccination coverage

For all Prudential Malaysia customers, we will be providing RM500 cash relief for hospitalisation due to adverse effects from immunisation (AEFI) within 7 days after an approved COVID-19 vaccination. We are the first life insurer and takaful operator in Malaysia to provide this coverage for your peace of mind.

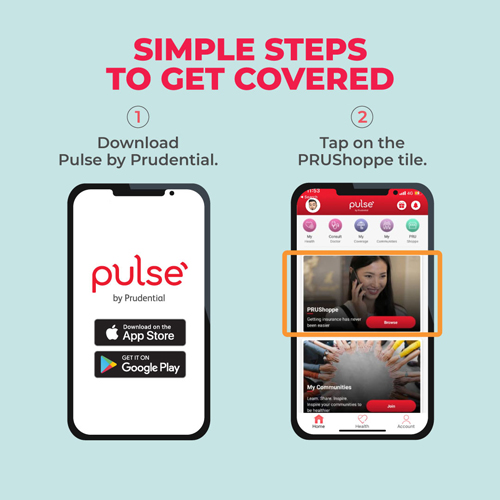

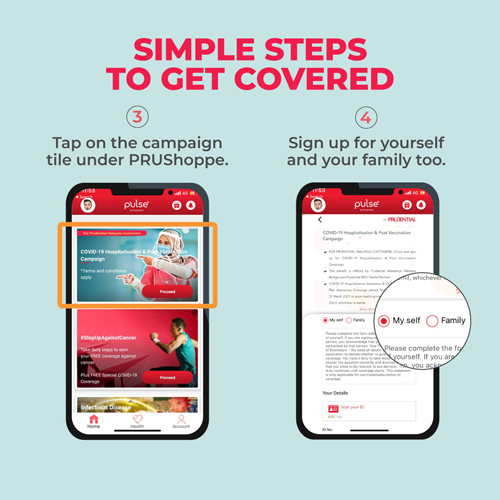

So, download Pulse by Prudential app now to sign up for COVID-19 Hospitalisation & Post Vaccination Campaign and check your coverage today! And you can sign up for your family too!

For more information, please refer to terms & conditions for each coverage under this Campaign, and Frequently Asked Questions below.

There is no better time to be a Prudential Malaysia customer. Speak to our Wealth Planner or Takaful Agent today to review your protection needs and find out more about the coverages we provide.

Learn More

COVID-19 Hospitalisation & Post Vaccination Campaign

Terms and Conditions

1. This COVID-19 Hospitalisation & Post Vaccination Campaign (“Campaign”) is provided by Prudential Assurance Malaysia Berhad and Prudential BSN Takaful Berhad (collectively referred to as “Prudential Malaysia”) on goodwill basis for Prudential Malaysia customers. Prudential Malaysia reserves the right to change any part of this Campaign or withdraw any part (or in whole) of this Campaign at any time with or without notice.

2. At all times, any insurance contracts and takaful certificates that provide for coverage on the hospitalisation claims arising from COVID-19, such insurance contracts and takaful certificates will always take precedence.

3. This Campaign provides three types of assistance/coverage (“coverage”). The coverage will be administered based on the terms and conditions set for this Campaign and each coverage, Frequently Asked Questions, as well as the eligibility criteria for each coverage, which are made available in the corporate website of Prudential Malaysia (“Prevailing Document”). Please note that the Prevailing Document shall prevail, in the event of any inconsistencies between the Prevailing Document and any other materials relating to this Campaign.

|

Coverage Category |

Coverage |

Category of Prudential Malaysia customer |

Coverage Period |

|

COVID-19 Hospitalisation Campaign |

COVID-19 Hospitalisation Assistance |

Prudential Malaysia customers who are covered under any Type B Medical Plans. |

8 February 2021 to 30 September 2021 or upon reaching maximum claims limit of RM20mil, whichever is earlier |

|

COVID-19 Upgraded Plan Assistance |

Prudential Malaysia customers who are covered under any Type B Medical Plans upgraded from PRUMajor Med series within the same policy as at 31 December 2020. |

||

|

COVID-19 Post Vaccination Campaign |

Post COVID-19 Vaccination Coverage |

All Prudential Malaysia customers.

|

8 February 2021 to 31 December 2021 or upon reaching maximum claims limit of RM1mil, whichever is earlier |

Type B Medical Plans (do not cover communicable disease requiring quarantine by law):

|

No |

PAMB Plan |

|

No |

PruBSN Plan |

|

1 |

PRUHealth |

|

1 |

Takaful Health |

|

2 |

PRUMedic Essential |

|

2 |

Takaful Health2 |

|

3 |

PRUFlexi Med |

|

3 |

HealthEnrich |

|

4 |

PRUValue Med |

|

4 |

HealthEnrich+ |

|

5 |

PRUMillion Med |

|

5 |

Medic Protector |

|

|

|

|

6 |

Health Protector |

|

|

|

|

7 |

Medic Essential |

Please take note that all Prudential Malaysia customers who are covered under Type A Medical plans, are covered for COVID-19. They are also eligible to sign up for Post COVID-19 Vaccination Coverage.

Type A Medical Plans (cover communicable disease requiring quarantine by law):

|

No |

PAMB Plan |

|

No |

PruBSN Plan |

|

1 |

PRUMajor Med |

|

1 |

Major Medical Cover |

|

2 |

PRUMajor Med 2 |

|

2 |

Major Medical Cover 2 |

|

3 |

PRUMajor Med 3 |

|

|

|

|

4 |

PRUMajor Med 4 |

|

|

|

|

5 |

PRUMajor Med 5 |

|

|

|

|

6 |

PRUSenior Med |

|

|

|

|

7 |

PRUGuard My Medical |

|

|

|

|

8 |

PRUParent |

|

|

|

4. This Campaign is complimentary to all eligible Prudential Malaysia customers who have signed up through Pulse by Prudential app.

5. Prudential Malaysia customer means Life Assured/Covered Person of all in-force individual policies/certificates and insured/ covered members of Group policies/certificates (e.g. MRTA policies / MRTT certificates / Credit Shield Plus / PRULoan Protect) underwritten by Prudential Assurance Malaysia Berhad (“PAMB”) or Prudential BSN Takaful Berhad (“PruBSN”) except Group Employer-Employee Benefit policies/certificates.

The coverage is meant for Prudential Malaysia customer, who has not previously made a claim under the coverage provided under this Campaign.

6. Prudential Malaysia customer that meets any of the criteria below is automatically signed-up as an eligible Prudential Malaysia customer for this Campaign:

i) holds an identity card other than MyKad i.e. MyKid, MyPR, MyTentera etc issued by the National Registration Department of Malaysia;

ii) a non-Malaysian, who does not hold any identity card issued by the National Registration Department of Malaysia;

iii) aged 60 or above 60 years old;

iv) aged 17 or below 17 years old; or

v) covered only under Group policies/certificates (e.g. MRTA policies/MRTT certificates / Credit Shield Plus / PRULoan Protect) underwritten by PAMB or PruBSN except Group Employer-Employee Benefit policies/certificates; or

vi) covered only under individual insurance product purchased from Pulse by Prudential app (PRUShoppe) (e.g. Infectious Disease Cover).

7. Each eligible Prudential Malaysia customer can only claim once under each Coverage Category, regardless of the number of policies / certificates held with Prudential Malaysia because this Campaign is provided on goodwill and individual basis.

In addition, COVID-19 Upgraded Plan Assistance and COVID-19 Hospitalisation Assistance will not apply to Prudential Malaysia customers, whose any part of the claims arising from COVID-19:

a) are payable under any insurance contract/takaful certificate issued by PAMB, PruBSN or any other insurer/takaful operator; and/or

b) are filed or covered under any fund, assistance, relief, campaign or its equivalent from any third party (e.g. government or industry fund).

8. The policies/certificates/medical plan that resulted in the eligibility of the coverage provided under this Campaign must be in-force upon diagnosis, hospitalisation and claims submission.

9. Prudential Malaysia customers, who are eligible for COVID-19 Upgraded Plan Assistance and COVID-19 Hospitalisation Assistance, can only start enjoying their respective coverage after the expiry of waiting period set in the medical plan.

10. The maximum amount that can be paid by Prudential Malaysia for the same person covered under COVID-19 Hospitalisation Assistance is the amount based on the highest Category (3/4/5) that this person is claiming for. Reference can be made to current Ministry of Health guidance (click here), to understand the clinical management of confirmed COVID-19 patients.

11. Claims must be submitted within 3 months from the diagnosis date. However, we will not be able to approve the claim once the maximum claims limit set for the respective Coverage Category is reached.

12. All documents as stated above must be submitted via PRUServe Plus or customers may email us at customer.mys@prudential.com.my or customer@prubsn.com.my. Customers can also submit the documents via Pulse by Prudential app, when the function is made available.

13. In case of dispute, Prudential Malaysia shall have the absolute right of final decision.

14. If there are any inconsistencies between the English and Bahasa Malaysia versions of this document, for the purposes of interpretation and construction, the English language version of this document shall prevail and be given effect to.

Terms and Conditions for each coverage provided under this Campaign

COVID-19 Upgraded Plan Assistance

1. Prudential Malaysia will provide reimbursements on goodwill basis for hospitalisation claims due to COVID-19 during the Coverage Period, of which the eligible Prudential Malaysia customer has received active treatment as Category 3/4/5 COVID-19 patient at a private hospital in Malaysia upon being referred to that same private hospital by the Ministry of Health Malaysia (MOH). Reference can be made to current Ministry of Health guidance (click here), to understand the clinical management of confirmed COVID-19 patients.

The reimbursement will be provided based on the limits as well as all other terms and conditions stated in the policy document of the Previous Medical Plan before the eligible Prudential Malaysia Customer is covered under the current upgraded medical plan. These include meeting the requirements for Medically Necessary and Reasonable and Customary Charges under the Previous Medical Plan.

‘Previous Medical Plan’ that is referred in this document refers to the medical plan listed in the table below, of which it has been upgraded to the current medical plan covering the eligible Prudential Malaysia Customer under same policy number as at 31 December 2020.

|

No. |

PAMB Plan |

|

1 |

PRUMajor Med |

|

2 |

PRUMajor Med 2 |

|

3 |

PRUMajor Med 3 |

|

4 |

PRUMajor Med 4 |

|

5 |

PRUMajor Med 5 |

2. The diagnosis by the treating doctors at hospitals authorized by the MOH in Malaysia.

3. The current upgraded medical plan must be in-force upon diagnosis, during the treatment due to COVID-19 and upon claims submission.

COVID-19 Hospitalisation Assistance

1. Prudential Malaysia will provide reimbursement on goodwill basis for hospitalisation claims due to COVID-19 during the Coverage Period, of which the eligible Prudential Malaysia customer has received active treatment as Category 3/4/5 COVID-19 patient at a private hospital in Malaysia upon being referred to that same private hospital by the Ministry of Health Malaysia (MOH). Reference can be made to current Ministry of Health guidance (click here), to understand the clinical management of confirmed COVID-19 patients.

2. The reimbursement is per individual basis (for each eligible Prudential Malaysia customer), subject to the following limits:

a) Up to RM5,000 for Category 3 COVID-19 patient

b) Up to RM15,000 for Category 4 COVID-19 patient

c) Up to RM20,000 for Category 5 COVID-19 patient

3. The diagnosis by the treating doctors at hospitals authorized by MOH in Malaysia.

4. Prudential Malaysia will assess the reimbursement claim based on Medically Necessary and Reasonable and Customary Charges, as explained later.

5. The policies/certificates/medical plan that resulted in the eligibility of this coverage must be in-force upon diagnosis, during the treatment due to COVID-19 and upon claims submission.

6. The maximum amount that can be paid by Prudential Malaysia for the same person covered under COVID-19 Hospitalisation Assistance is the amount based on the highest Category (3/4/5) that this person is claiming for. E.g., for an eligible Prudential Malaysia customer’s condition progressed from being a Category 3 COVID-19 patient to a Category 5 COVID-19 patient, the maximum amount that Prudential Malaysia can reimburse under this coverage shall be RM20,000.

7. “Medically Necessary” means a medical service, which is:

a) consistent with the diagnosis and customary medical treatment for COVID-19;

b) in accordance with standards of good medical practice, consistent with current standard of professional medical care, and of proven medical Campaigns;

c) not for the convenience of the eligible Prudential Malaysia customer or the doctor, and unable to be reasonably rendered out of the Private Hospital;

d) not of an experimental, investigational or research nature, preventive or screening nature;

e) for which the charges are fair and reasonable and customary for COVID-19; and

f) provide treatment directly related to the covered COVID-19.

8. “Reasonable and Customary Charges” mean charges for medical care which is Medically Necessary shall be considered reasonable and customary to the extent that it does not exceed the general level of charges being imposed by other legally registered providers of medical or healthcare services of similar standing within Malaysia.

Such charges when incurred, taking into consideration similar or comparable treatment, services or supplies to individual of the same gender and of comparable age of similar sickness, disease or injury and in accordance with accepted medical standards and practice could not have been omitted without adversely affecting the eligible Prudential Malaysia customer’s medical condition.

Post COVID-19 Vaccination Coverage

1. Prudential Malaysia will provide RM500 Cash Relief on goodwill basis for hospitalisation in Malaysia due to serious adverse effect(s) from immunisation (“AEFI”) within 7 days after receiving an approved COVID-19 vaccination during the Coverage Period.

2. This Post COVID-19 Vaccination Coverage is available for any vaccination related adverse reaction (also known as adverse event following immunisation "AEFI") which is serious and requiring medically necessary hospitalisation (hospitalisation in Malaysia) within 7 days after receiving an approved COVID-19 vaccination. An AEFI will be considered serious, if the AEFI is life-threatening, may result in persistent or significant disability/incapacity and requires in-patient hospitalisation, for medical intervention to prevent permanent impairment or damage.

3. The vaccination, including the first dose and subsequent doses must be approved and administered by a registered medical personnel at a Ministry of Health Malaysia's designated location in Malaysia.

Frequently Asked Questions

1. What is COVID-19 Hospitalisation & Post Vaccination Campaign?

-

This COVID-19 Hospitalisation & Post Vaccination Campaign (“Campaign”) is specially designed by Prudential Malaysia to support our Prudential Malaysia customers so that we can provide them with financial freedom and peace of mind during this challenging time.

-

There are 3 coverage provided under this Campaign. The coverage will be administered based on the terms and conditions set for this Campaign and each campaign, Frequently Asked Questions, as well as the eligibility criteria for each coverage:

- COVID-19 Upgraded Plan Assistance

- COVID-19 Hospitalisation Assistance

- Post COVID-19 Vaccination Coverage

Briefly, when a Prudential Malaysia customer is eligible for COVID-19 Upgraded Plan Assistance (or COVID-19 Hospitalisation Assistance), Prudential Malaysia will provide reimbursement on goodwill basis for medical expenses resulted from the hospitalisation treatment due to COVID-19 infection.

As for Post COVID-19 Vaccination Coverage, the campaign provides cash relief when the eligible Prudential Malaysia customer is hospitalised due to serious adverse effect(s) from immunisation (AEFI) after COVID-19 vaccination.

Prudential Malaysia customer means Life Assured/Covered Person of all in-force individual policies/certificates and insured/ covered members of Group policies/certificates (e.g. MRTA policies / MRTT certificates / Credit Shield Plus / PRULoan Protect) underwritten by Prudential Assurance Malaysia Berhad (“PAMB”) or Prudential BSN Takaful Berhad (“PruBSN”) except Group Employer-Employee Benefit policies/certificates. The policies/certificates/medical plan that resulted in the eligibility of the coverage provided under this Campaign must be in-force upon diagnosis, hospitalisation and claims submission.

2. What are the eligibility criteria for the coverage provided under this Campaign?

COVID-19 Hospitalisation Campaign

|

Group |

Type of Prudential Malaysia customer |

Eligible Coverage |

Coverage Period |

|

1 |

All Prudential Malaysia customers who signed up in Pulse by Prudential app AND who are covered only under any Type B Medical Plans upgraded from Previous Medical Plan within same policy number as at 31 December 2020.

(Excluding those falling under Group 3) |

COVID-19 Upgraded Plan Assistance

Note: The reimbursement will be managed based on Previous Medical Plan terms and conditions. “Previous Medical Plan” is explained in the terms and conditions for COVID-19 Upgraded Plan Assistance. |

8 February 2021 to 30 September 2021 or upon reaching maximum claims limit of RM 20mil, whichever is earlier |

|

2 |

All Prudential Malaysia customers who signed up in Pulse by Prudential app AND who are covered under any Type B Medical Plans.

(Excluding those falling under Group 1 and Group 3) |

COVID-19 |

|

|

3 |

All Prudential Malaysia customers with any Type A Medical Plan that provides for reimbursement of medical expenses |

Not applicable.

Type A Medical Plan provides for medical coverage for COVID-19. The medical expenses for hospitalisation due to COVID-19 will be reimbursed based on medical plan’s terms and conditions. |

Not applicable. |

COVID-19 Post Vaccination Campaign

|

Type of Prudential Malaysia customer |

Eligible Coverage |

Coverage Period |

|

All Prudential Malaysia customers who signed up in Pulse by Prudential app |

Post COVID-19 Vaccination Coverage

|

8 February 2021 to 31 December 2021 or upon reaching maximum claims limit of RM 1mil, whichever is earlier |

Type A Medical Plans (covers communicable disease requiring quarantine by law):

|

No. |

PAMB Plan |

|

No. |

PruBSN Plan |

|

1 |

PRUMajor Med |

|

1 |

Major Medical Cover |

|

2 |

PRUMajor Med 2 |

|

2 |

Major Medical Cover 2 |

|

3 |

PRUMajor Med 3 |

|

|

|

|

4 |

PRUMajor Med 4 |

|

|

|

|

5 |

PRUMajor Med 5 |

|

|

|

|

6 |

PRUSenior Med |

|

|

|

|

7 |

PRUGuard My Medical |

|

|

|

|

8 |

PRUParent |

|

|

|

Type B Medical Plans (do not cover communicable disease requiring quarantine by law):

|

No. |

PAMB Plan |

|

No. |

PruBSN Plan |

|

1 |

PRUHealth |

|

1 |

Takaful Health |

|

2 |

PRUMedic Essential |

|

2 |

Takaful Health2 |

|

3 |

PRUFlexi Med |

|

3 |

HealthEnrich |

|

4 |

PRUValue Med |

|

4 |

HealthEnrich+ |

|

5 |

PRUMillion Med |

|

5 |

Medic Protector |

|

|

|

|

6 |

Health Protector |

|

|

|

|

7 |

Medic Essential |

3. What is the Coverage Period for each coverage under this Campaign?

|

Coverage |

Coverage Period |

|

COVID-19 Upgraded Plan Assistance |

8 February 2021 to 30 September 2021 or upon reaching maximum claims limit of RM 20mil, whichever is earlier |

|

COVID-19 Hospitalisation Assistance |

|

|

Post COVID-19 Vaccination Coverage |

8 February 2021 to 31 December 2021 or upon reaching maximum claims limit of RM 1mil, whichever is earlier |

4. How much does this COVID-19 Hospitalisation & Post Vaccination Campaign cost me?

This COVID-19 Hospitalisation & Post Vaccination Campaign is free for all Prudential Malaysia customers who signed up in Pulse by Prudential app.

5. How do I sign up for this COVID-19 Hospitalisation & Post Vaccination Campaign?

You may download “We Do Pulse” from App Store or Google Play Store. Then go to “Home Tab”, “PRUShoppe”, search for “COVID-19 Hospitalisation & Post Vaccination Campaign”.

6. Why do I need to register with Pulse by Prudential app to sign up for COVID-19 Hospitalisation & Post Vaccination Campaign?

Pulse by Prudential app is an All-in-One AI health app that provides users with a range of easily accessible AI health tools. This Campaign is launched with the objective to provide additional COVID-19 assistance to Prudential Malaysia customer on goodwill basis, aims to support our customers with holistic health and protection assistance especially in time of need.

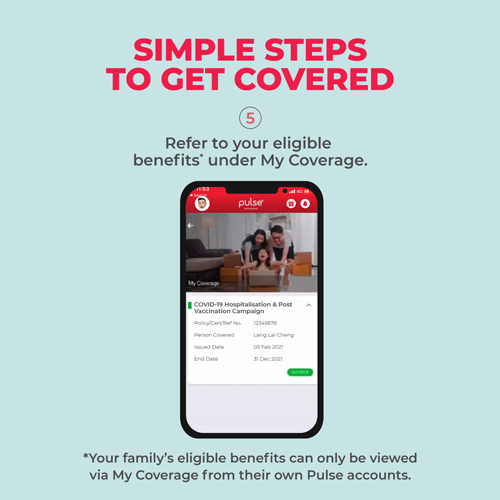

Upon successful sign up for the Campaign, customers can view their respective benefit details under MyCoverage easily. As customer privilege, Prudential Malaysia customers can access quick doctor consultation for FREE via video or audio call at the comfort of your own home. Or access Symptom Checker to understand your condition better to ease your worry if you are unclear about your symptoms. Users can also tap into a wide range of health and wellness tools, communities and content via Pulse to stay healthy and positive in time of need.

7. How do I sign up this COVID-19 Hospitalisation & Post Vaccination Campaign under Pulse by Prudential app for my family members?

Your family member is advised to download “We Do Pulse” from App Store or Google Play Store to sign up for this Campaign.

8. If I am covered under Type A Medical Plan, do I still need to sign up via Pulse by Prudential app to enjoy the medical coverage?

No. However, Post COVID-19 Vaccination Coverage is only applicable for Prudential Malaysia customer that signs up via Pulse by Prudential app.

9. I am covered under Type B Medical Plan. Can I submit reimbursement claim for COVID-19 Hospitalisation & Post Vaccination Campaign, if I sign up via Pulse by Prudential app only after I was diagnosed with COVID-19 but before I was hospitalised?

To be eligible, you are encouraged to sign up for COVID-19 Hospitalisation & Post Vaccination Campaign via Pulse by Prudential app before you are diagnosed with COVID-19 and hospitalised.

10. Is Hospital Alliance Services (“HAS”) (cashless facility) available for hospitalisation due to COVID-19?

No, HAS (cashless facility) is not available for COVID-19 related admissions. The claims submitted under Type A Medical Plan, COVID-19 Upgraded Plan Assistance and COVID-19 Hospitalisation Assistance are on reimbursement basis. This means you need to pay the bills first, then submit claim for reimbursement.

11. I am eligible for COVID-19 Upgraded Plan Assistance (or COVID-19 Hospitalisation Assistance). Can I submit reimbursement claim for COVID-19 Hospitalisation & Post Vaccination Campaign, if I am a Category 1 or 2 COVID-19 patient but I am required to be hospitalised in a private hospital according to my doctor’s recommendation?

For a COVID-19 patient with no symptoms (Category 1 - asymptomatic) or who does not require active treatment i.e. in quarantine only (Category 1 - asymptomatic or Category 2 - symptomatic, no pneumonia), any services received during the hospitalisation would not be deemed as medically necessary. Hence, the expenses incurred will not be reimbursed under the Campaign.

12. How do I submit a claim for hospitalisation due to COVID-19?

You can submit the required documents as below and submit to our nearest branch or submit them to your agent for the agent’s submission via PRUServe Plus (“PSP”). You can also submit the documents via Pulse by Prudential app, when the function is made available.

The documents required are as follows:

i) Claim Form

ii) Original hospital invoices & payment receipts*

iii) Copy of itemised bills *

iv) Discharge Summary

v) All Imaging and laboratory reports such as x-rays and blood test results

vi) Supporting documents from Ministry of Health medically trained personnel or officer referring you to the private hospital and/or the name and contact details of any Ministry of Heath personnel attending to you.

(*not required if claiming for Hospital Income benefit only)

Kindly note that the list of documents above may be revised as and when required for claim assessment.

13. I am eligible for COVID-19 Hospitalisation Assistance. My condition progressed from being a Category 2 COVID-19 patient to Category 4 COVID-19 patient. What can I claim for under this coverage?

You can submit reimbursement claims for medical expenses incurred when you are receiving active treatment as a Category 4 COVID-19 patient at a private hospital in Malaysia upon being referred to that same private hospital by the Ministry of Health Malaysia (MOH). The maximum amount of reimbursement that you can claim is up to RM15,000 for Category 4. We will assess the claims based on the terms and conditions set for this Campaign and the coverage, as well as the Frequently Asked Questions.

14. I am eligible for COVID-19 Upgraded Plan Assistance. My condition progressed from being a Category 2 COVID-19 patient to Category 4 COVID-19 patient. What can I claim for under this coverage?

You can submit reimbursement claims for medical expenses incurred when you are receiving active treatment as a Category 4 COVID-19 patient at a private hospital in Malaysia upon being referred to that same private hospital by the Ministry of Health Malaysia (MOH). We will assess the claims based on the terms and conditions set for this Campaign and the coverage, as well as the Frequently Asked Questions.

15. Is there any waiting period imposed for claim made under the coverage provided under this Campaign?

Yes. Prudential Malaysia customers, who are eligible for COVID-19 Upgraded Plan Assistance and COVID-19 Hospitalisation Assistance, can only start enjoying their respective coverage under this Campaign after the expiry of waiting period set in the medical plan.

16. I am eligible for COVID-19 Upgraded Plan Assistance (or COVID-19 Hospitalisation Assistance). Can I submit claim under the coverage for pre or post-hospitalisation expenses incurred?

No. The coverage only provides reimbursement on goodwill basis for expenses incurred for hospitalisation claims due to COVID-19.

17. I am eligible for COVID-19 Upgraded Plan Assistance (or COVID-19 Hospitalisation Assistance). Can I submit claim under the coverage for expenses incurred for in-hospitalisation treatment for subsequent complication sustained due to COVID-19, e.g: Pneumonia?

No. The coverage only provides reimbursement on goodwill basis for expenses incurred for hospitalisation claims due to COVID-19.

18. I am covered under a Type A Medical Plan from Prudential Assurance Malaysia Berhad and Type B Medical Plan from Prudential BSN Takaful Berhad. Am I eligible for COVID-19 Upgraded Plan Assistance, or COVID-19 Hospitalisation Assistance or both?

No, you are not eligible for COVID-19 Upgraded Plan Assistance and COVID-19 Hospitalisation Assistance. But, you are eligible for Post COVID-19 Vaccination Coverage when you sign up via Pulse by Prudential app.

19. I am covered under Type B Medical Plan from Prudential Assurance Malaysia Berhad and another Type B Medical Plan from Prudential BSN Takaful Berhad. Am I eligible for 2 times for coverage under COVID-19 Hospitalisation Campaign, when I sign up via Pulse by Prudential?

No. You are only eligible for 1 time, for either COVID-19 Upgraded Plan Assistance or COVID-19 Hospitalisation Assistance (depending on the eligibility criteria). Once you make a reimbursement claim under your eligible coverage under COVID-19 Hospitalisation Campaign, you are no longer eligible for any other coverage on COVID-19 Hospitalisation Campaign. You can submit the claim either to Prudential Assurance Malaysia Berhad or Prudential BSN Takaful Berhad.

20. I submitted a claim for reimbursement previously under the coverage under COVID-19 Hospitalisation Campaign when I received treatment in the hospital due to COVID-19. Recently, I am hospitalized again as Category 4 COVID-19 patient for the second COVID-19 infection. Am I still eligible to claim under the coverage?

No. The coverage under COVID-19 Hospitalisation Campaign is only meant for Prudential Malaysia customers, who have not previously made a claim under COVID-19 Hospitalisation Campaign.

21. Will a claim under this COVID-19 Hospitalisation & Post Vaccination Campaign use up the annual/lifetime limit under my current medical plan?

Any claim made under the coverage provided under COVID-19 Hospitalisation & Post Vaccination Campaign does not affect your current medical plan Annual/Lifetime Limit.

22. I have submitted a claim previously under Special COVID-19 Coverage 2021. Can I still participate in this Campaign?

Yes, you can still participate in this Campaign and the eligibility criteria for the coverage under this Campaign are not affected by your previous claim under Special COVID-19 Coverage 2021.

23. I have been hospitalised in a private hospital to receive treatment for heart attack. I am subsequently confirmed as a Category 4 COVID-19 patient during the same hospitalisation. My insurance and takaful coverage do not cover for medical expenses incurred to treat COVID-19 infection. Will I be able to seek assistance from this COVID-19 Hospitalisation & Post Vaccination Campaign?

If you are eligible for COVID-19 Upgraded Plan Assistance or COVID-19 Hospitalisation Assistance, Prudential Malaysia can consider waiving the requirement for referral notice issued by the MOH so that we can consider your claim for reimbursements for the treatment received when you are confirmed as Category 4 COVID-19 patient. Please refer to the terms and conditions set for this Campaign and each coverage, Frequently Asked Questions, as well as the eligibility criteria for the coverage, to understand how the coverage works.

24. Can Life Assured/Covered Person take the COVID-19 vaccination from anywhere?

The vaccination, including the first dose and subsequent doses must be approved and administered by registered medical personnel in Ministry of Health Malaysia’s designated location within Malaysia.

25. How do I submit a claim under Post COVID-19 Vaccination Coverage?

You can submit the required documents as below via Pulse by Prudential app (when the function is made available) or submit to our nearest branch or submit them to your agent for the agent’s submission via PRUServe Plus (“PSP”).

Completed medical claim form (for non-PSP submission) and application for direct credit/e-credit details.

i) Medical report/discharge summary/doctor’s statement with complete diagnosis and treatment plan; and

ii) Claimant’s record of COVID-19 vaccination with the name of the vaccine and the date of the vaccine administration (for hospitalisation due to serious AEFI post COVID-19 vaccination)

26. Who will receive the payout pursuant to the approval of claim under this Campaign?

Prudential Malaysia will pay the payout to the policyholder/ certificate holder of the policies/certificates/medical plan that resulted in the eligibility of the coverage provided under this Campaign or the assignee or the policyholder/certificate holder’s legal representative.

27. Why is the Sum Covered showing RM0.00 in My Coverage for the COVID-19 Hospitalisation and Post Vaccination Campaign?

Please ignore the Sum Covered amount of RM0.00. Your eligibility under this Campaign is as per stated in the Benefits > Summary section of My Coverage.

28. Who do I contact for further clarification?

|

|

Prudential Assurance Malaysia Berhad |

Prudential BSN Takaful Berhad |

|

Customer Service |

603-2771 0228 |

603-2775 7188 |

|

|

We are here to help you